Perth Hits A High

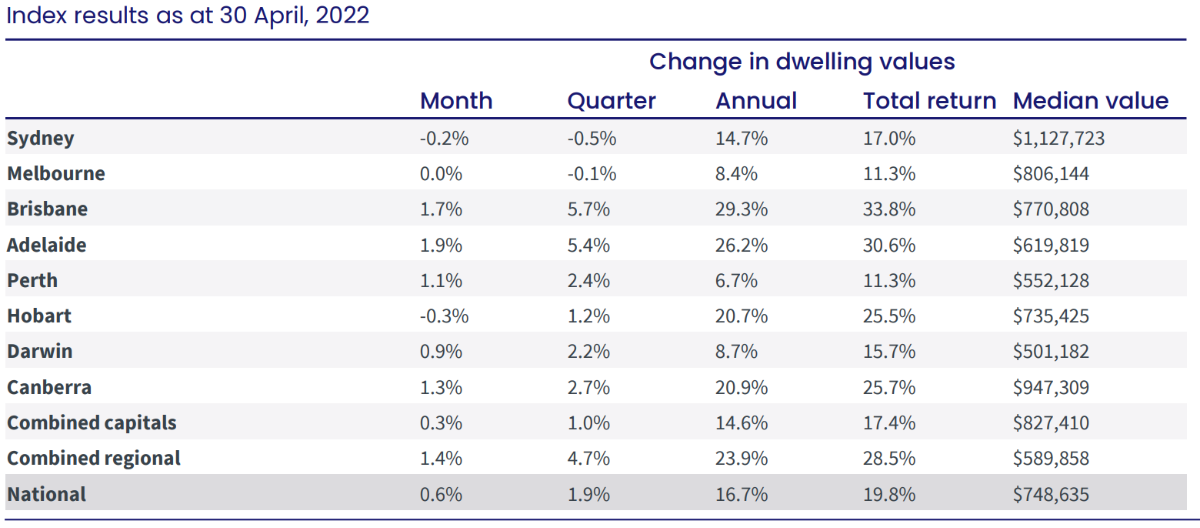

CoreLogic’s home value index has seen Perth’s house prices continue to record steady growth, despite the negative movement being seen in other parts of the nation. In fact, according to CoreLogic, Perth housing values have hit a record high.

Perth housing values increased 1.1% throughout April, putting values 0.9% higher than they were in June 2014, when CoreLogic recorded the previous peak.

Despite the market growth, Perth is still one of the most affordable capital cities in the nation, second only to Darwin. Perth’s gross rental yields of 4.4% are also among the best of all the capital cities, again being second only to Darwin.

ABS data shows investors nationally account for 32.5% of mortgage demand, although in WA they make up a much smaller portion at just 25.7%. Perth’s low buy in price, combined with it’s high rental yields will continue to attract investors and that proportion will grow in the near future.

Source: CoreLogic

Interest Rate Impact

For the first time in over 11 years, the Reserve Bank of Australia increased interest rates in May. In a release by Governor Philip Lowe, the RBA stated that it was “time to begin withdrawing some of the extraordinary monetary support that was put in place to help the Australian economy during the pandemic”

The cash rate had been held at an emergency low of 0.1% since November 2020, and interest rates remained at this record low level for 18 months. In what is expected to be just the beginning of rate rises, the RBA increased the official cash rate by 25 basis points to 0.35%.

While rising interest rates will cause some slowing to the housing market, it’s not all bad news. The unemployment rate remains low, and wages are expected to grow. Additionally, homeowners have been making the most of the record low interest rates, and in general are ahead on their mortgage repayments. Also reassuring, is the fact that borrowers are assessed on their ability to repay a loan at an interest rate of 2.5% to 3% higher than the current interest rate.

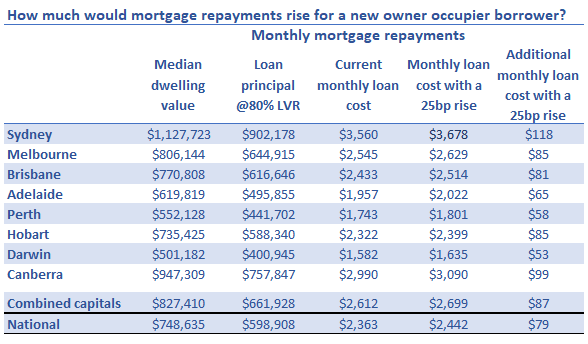

Perth homeowners are once again in one of the best positions in the nation though, as the below table shows, having one of the lowest increases in additional monthly mortgage repayments in the nation. According to the ANZ CoreLogic housing affordability report released in this month, the ratio of housing values to household income nationally is at a record high of 8.5. For Perth however, the ratio is only 5.8.

Whist nationally the portion of income required to service a new mortgage is 45.2% for houses, in Perth the portion is a much lower 29.5%. And although years to save a deposit hit a national record high of 11.4 years, in Perth the time is much shorter at only 7.7 years. Perth’s affordable housing and high incomes mean that interest rate increases are expected to have a minimal impact on our local property market.

Source: CoreLogic. Scenario assumes a current variable mortgage rate of 2.49%, monthly P&I loan repayments over 30 years.

Perth Suburbs Moving Up

Five suburbs saw their average house sale prices increase by 2.5% or more for the month of April, well above the 1.1% increase for the month. Wembley Downs took out first place with an impressive 2.9% increase, bringing average house prices in the suburb to $1.3 million.

Close behind was Maddington, where prices rose 2.8% to $360,000. Third and forth places were tied, with Waikiki and Carramar both increasing 2.7% to $407,125 and $565,000 respectively.

City Beach came in at fifth place for April with house prices rising to $2.325 million, which represents growth of 2.5%. Thornlie, Ballajura, Karrinyup and Mosman Park also performed well for the month.

Outlook for Perth

During the month of April we have seen an increase in investor activity due to the affordability of Perth prices, strong yields and low vacancy rates. Home buyers in sought after areas are still extremely active, days on market are still extremely low and multiple offers and prices above the asking price are being achieved. With only around 8,000 properties for sale in Perth, demand is exceeding supply and not enough new properties coming to market to sufficiently stifle competition amongst buyers.

The Real Estate Institute of Western Australia is still forecasting 10% growth during the 2022 calendar year.

What’s Happening at Resolve?

At Resolve Property Solutions, we have expanded our team adding more resources and getting more opportunities for suitable properties as possible for our clients. As well as sourcing properties which meet our clients brief and budget, we also search for off-market opportunities where possible to provide more options, and always ensure they are buying the right property at the right price.

Now more then ever it is important to get an accurate and up to date appraisal for your property purchase and avoid over paying.

During the month of April we purchased 7 properties for our clients with over 40% off market or pre market purchases.

If you would like to discuss your property requirements and strategy with our buyers agent, book your free consultation here.

We are here to help you on your property journey.