Perth Home Buyers Budget Winners

The big news for housing from the Morrison government’s last budget before the federal election is the expansion of the Home Guarantee Scheme, which used to be called the First-Home Loan Deposit Scheme.

The Home Guarantee Scheme allows a first-home buyer to buy a home with just a 5% deposit, with the government guaranteeing the remaining 15%. This will allow first home buyers to purchase sooner than they otherwise could, as well as removing the additional cost of mortgage insurance.

Previously, this scheme provided 10,000 places for first home buyers purchasing established homes and another 10,000 for new homes. Under the expanded scheme, 35,000 first-time home buyers purchasing established homes will be eligible to take part.

Two additional schemes will run for the next three years. The new Regional Home Guarantee offers a further 10,000 places each year to those buying a brand-new home in a regional area. This will be available to first home buyers as well as anyone who hasn’t owned a property for five years or more, and permanent migrants.

The Family Home Guarantee will offer 5000 places exclusively to single parents, allowing them to buy a home with a deposit of as little as 2%.

Buyers with a pre-tax salary of $125,000 for single applicants and $200,000 for combined households will be eligible for the scheme, which will exclude only a small portion of working Australians.

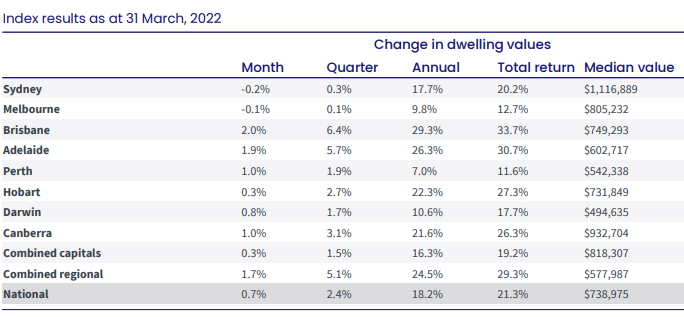

Purchase price caps will be the biggest constraint for buyers. These limits are determined by state, and by whether the property is in a city or regional area. Based on the existing caps, Perth first home buyers are among the most fortunate in the nation. The Perth purchase price cap is currently $500,000, only just short of the $542,000 average house price. First home buyers in Perth will have access to a greater proportion of properties, although competition at that price point will also greatly increase.

Source: CoreLogic

Perth Suburbs Moving Up

Some suburbs saw their average house sale prices grow well above the 1% average for Perth throughout March. The standout among these is East Fremantle, where average house sale prices increased 4.8% to $1.38 million. Close behind with an increase of 4.3% was Mount Hawthorn, where average house sale prices rose to $1.16 million.

Treeby took out third place. Average house sale prices for March were $577,000, which is an increase of 3.8%. East Victoria Park came next for the month, prices there rising 2.8% to $705,000.

Waikiki rounded out the top five list, with prices up 2.6% to $390,000. Craigie, Spearwood and Yangebup also performed well for March.

Outlook for Perth

During the month of March, we saw more interstate investors enter the property market due to Perth being the most affordable capital city in Australia, with strong rental yields and tight supply levels. There were less than 8,000 properties for sale on average in Perth during March, a 10% decrease compared to the same time last year. The average days on market also dropped to 16 days.

In accordance with REIWA, the outlook for Perth for the remainder of 2022 is for a further price increase of 10% growth for the calendar year and conditions aren’t expected to slow any time soon.

What’s Happening at Resolve?

At Resolve Property Solutions, we are working with our clients to gain access to as many suitable properties as possible. As well as sourcing properties which meet our clients brief, we also search for off-market opportunities where possible to provide more options, and always ensure they are buying the right property at the right price.

During the month of March, our team worked hard and purchased eight properties for our clients with a massive 50% of these being either off-market or pre-market.

If you would like to discuss your property requirements and strategy with our buyers agent, book your free consultation here.

We are here to help you on your property journey.