Why Investors Prefer Perth

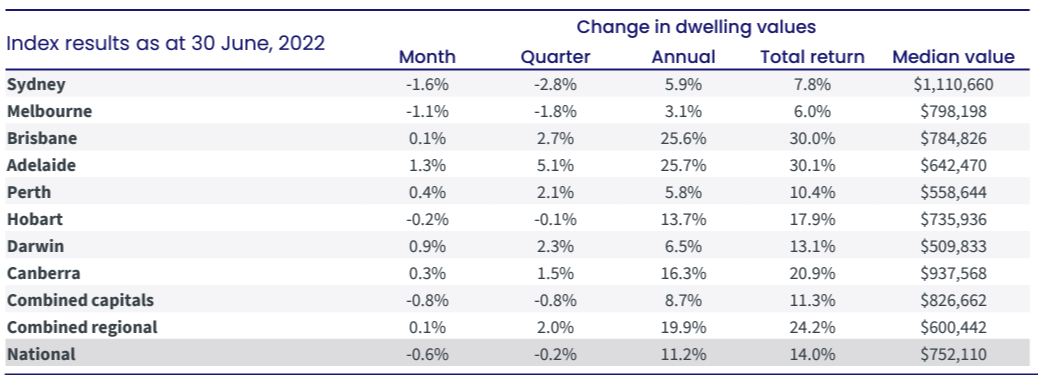

The latest lending indicators, released by the Australian Bureau of Statistics (ABS), reveal a 23% increase in lending to property investors in the twelve months to May 2022. With the latest CoreLogic data showing Perth house prices continued their upward trend and grew 0.4% in June, in the face of a 0.6% decline in national prices, it’s little wonder that the majority of investors put Perth at the top of their list of preferred cities to buy in.

Perth remains one of the most affordable capital cities, with prices being almost half that of houses in Sydney, making the Perth property market increasingly accessible for investors. Add to that Perth’s 4.4% gross rental yields, and you have an extremely attractive market for investors.

Perth’s housing affordability and rental yields are second only to Darwin, however, vacancy rates are higher in Darwin than in Perth. A smart investor knows there is nothing to be gained from an empty investment property.

Additionally, ABS data reveals negative interstate migration for the Northern Territory and much smaller population growth overall annually compared to Western Australia. Western Australia experienced the second largest annual population growth and a net increase in interstate migration. Continuing demand will see Perth house prices and rental yields remain strong.

Source: CoreLogic

Perth Suburbs Moving Up

Closing out the financial year with a bang, Edgewater and Riverton both experienced 3.3% increases in their average house sale prices for the month of June. In Edgewater, average house sale prices rose to $620,000 and in Riverton, prices hit $736,500.

Kalamunda ranked third for the month, with average house sale prices rising to $735,000, an increase of 2.8% for the month. Jindalee was next, experiencing a 2.4% increase in June, with prices growing to $640,000.

Very close behind, Padbury rounded out the tope five list for June, with a 2.3% increase to $655,000. Shenton Park, Mullaloo, Seville Grove and Alkimos also saw strong growth throughout June.

Follow us on Instagram before 15th August 2022 for your chance to win a $200 eftpos Gift Card

Outlook for Perth

During the month of June we continued to see investor activity increase as more investors realise the potential of the Perth property market, including higher rental yields and low vacancy rates. Internal migration is continuing to increase as more people are relocating from the eastern states to Perth for more affordable housing, job opportunities and great lifestyle.

Local home buyers are still out in full force. Family homes remain in great demand, selling quickly and receiving multiple offers. Downsizers have been more active as well, seeking lower maintenance options and releasing capital from their family homes.

With Perth being the most affordable capital city in Australia along with the continuing increase in demand, the Perth market is well placed to maintain it’s strong performance over the rest of the year.

What’s Happening at Resolve?

At Resolve Property Solutions, our team is working harder than ever to source and inspect as many suitable properties as possible for our clients. As well as sourcing properties which meet our clients brief and budget, we also search for off-market opportunities where possible to provide more options, and always ensure they are buying the right property at the right price.

Now more then ever it is important to get an accurate and up to date appraisal for your property purchase and avoid over paying.

During the month of June we purchased six properties for our clients, with over 33% off market or pre market purchases.

If you would like to discuss your property requirements and strategy with our Buyers Agents, book your free consultation here.

We are here to help you on your property journey and ensure you are buying the right property, in the right location for the right price!