Perth Property Market Strong But Affordable

2021 is proving to be a year of economic recovery after a challenging end to 2020, and the speed of the post-COVID recovery continues to surprise experts. Perth is no exception, with some suburbs even exceeding their highest recorded average house sale price.

The Perth property market saw it’s last peak in 2014, when the average house sale price hit $545,000. Now, twenty suburbs have seen their average prices exceed where they were in 2014.

Cottesloe was the best performing suburb, with its average lifting 22% since 2014, to $2.262 million in the March 2021 quarter. A close second was Floreat, with its average now sitting 19% above its June 2014 quarter average at $1.565 million.

City Beach and South Perth were the next best performers, rising 15% and 13% respectively since their average June 2014 quarter price. And both Nedlands and Mosman Park increased 11% from their 2014 price.

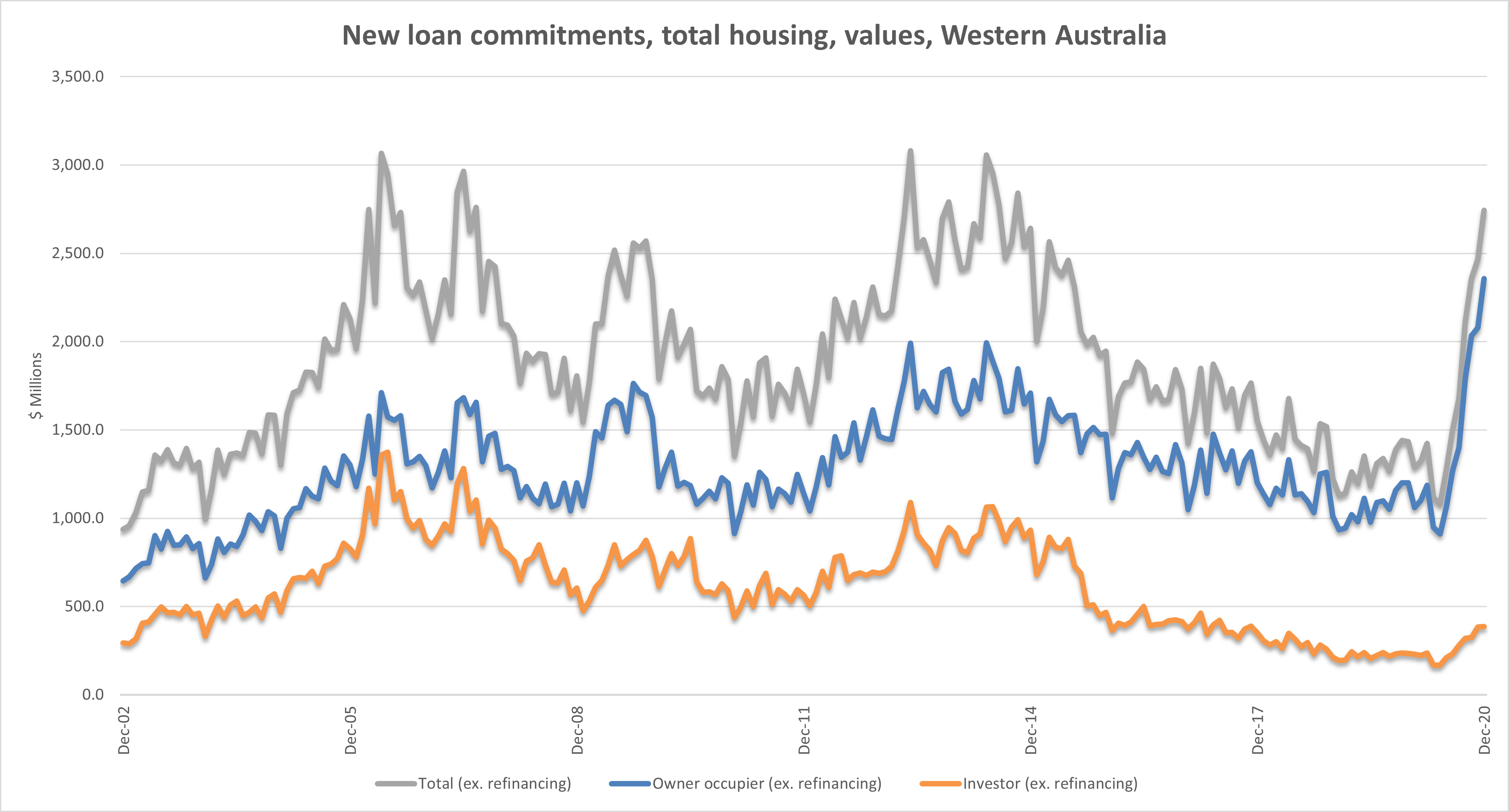

While the WA property market is experiencing growth, it isn’t in all segments and some areas are experiencing higher demand than others. An example of this is apartments, which in conjunction with escalating building costs is slowing developers demand for project sites. The rental market also continues to have short supply. This trend has finally encouraged investors back into the market, as demonstrated on the graph below.

Source: Australian Bureau of Statistics

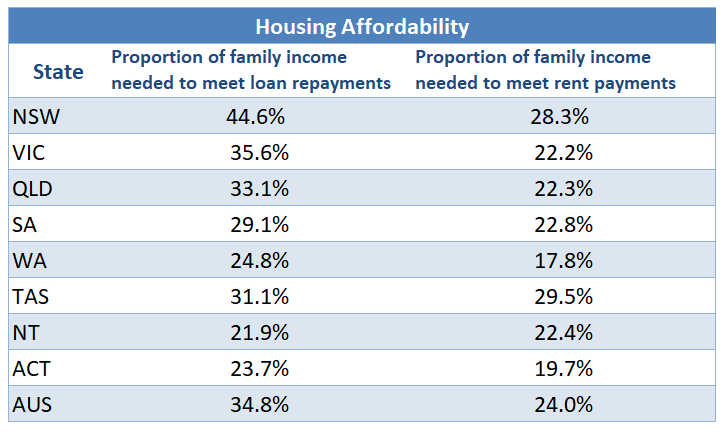

The positive news though, is that Western Australia is still one of the most affordable states to live in, whether you are buying or renting.

Source: REIWA

Perth Suburbs Moving Up

The five biggest growth suburbs for May were Attadale, which increased 4.9% to $1.25 million, Scarborough, rising 3.8% to $755,0000, Melville, with a 3.6% increase to $860,000, South Lake, up 3.6% to $400,000 and Hamilton Hill with an increase of 3.5% to $490,000.

With more people recognising that now is good time to sell their home, there is an increased number of properties on the market, which is good news for buyers. However, the average time to sell for May is still only 14 days. Whilst this is one day longer than in April, buyers still need to act quickly to secure a property. Having a buyers agent provide expert advice has enabled numerous clients of Resolve Property Solutions to achieve their property goals.

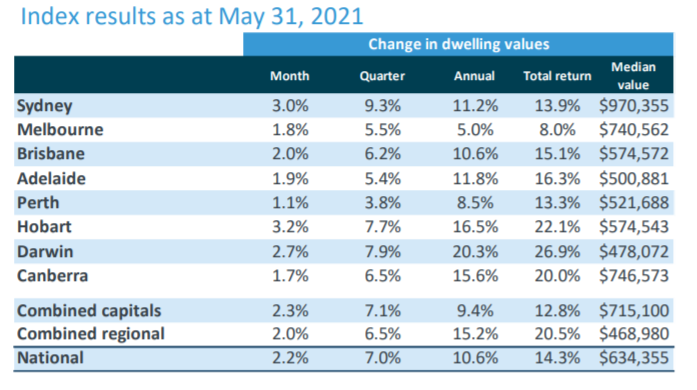

Source: Corelogic

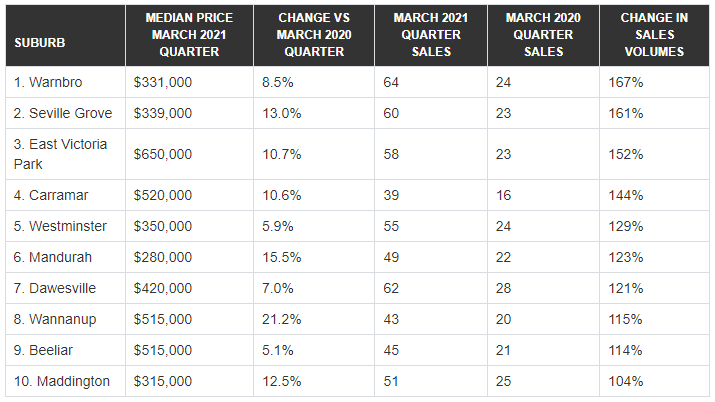

Sales activity more than doubles in 10 Perth suburbs

The March quarter saw strong growth across Perth, with a 31% increase compared to same time last year. However ten suburbs were clear stand outs, with over 100% sales growth during that time.

Out of the ten suburbs on this list, Warnbro recorded the biggest increase, with 167% more sales for the March quarter of 2021 than the same time last year. Seville Grove was a close second with 161%, and East Victoria Park came in third at 152%. These were followed by Carramar at 144% and Westminster with 129%,

While Mandurah ranked sixth with a 123% increase in sales activity, it saw the second largest increase in average sales price, up 15.5% to $280,000. Wannanup, with a 121% increase in sales volume, recorded the biggest increase to it’s average sales price, rising 21.2% to $515,000.

The fact that the majority of these suburbs with substantial sales activity growth still have an average sale price around or below the Perth average of $510,000 is noteworthy. It suggests that many first home buyers are taking advantage of relatively affordable prices and record low interest rates, opting to buy instead of rent.

Source: REIWA

Federal Budget 2021: What it means for Property

Property markets across Australia have performed strongly over the start of 2021. A combination of record-low interest rates, a limited number of properties on the market for sale and government stimulus measures have seen home values grow considerably since the start of the year. The 2021/22 Federal budget contains several measures which will directly assist, and positively support, property markets across the country.

First home buyers and single parents are the big winners again in this year’s big-spending and jobs-focused Federal Budget. The New Home Guarantee and First Home Super Saver Scheme provide a more accessible pathway for first home buyers to save for a house deposit. A new scheme, the Family Home Guarantee, which focuses on single parents with dependents, is a welcome measure. This will provide the assistance required for the challenges faced by single-income households to save for a deposit to re-enter the property market or purchase their first home.

The biggest housing initiative in the budget is aimed at encouraging more Australians nearing retirement to downsize from the family home, by extending access to a superannuation contribution scheme. The Downsizer Scheme, which allows downsizers to turbocharge their super (up to $300,000) when they sell the family home, has been extended.

Previously, only those aged 65 and over were able to access the scheme. Now, anyone aged 60 and over has access, and the work test is no longer required, meaning you don’t need to prove you worked before accessing the concessions.

A budget document focused on women’s issues stated the change will give people more flexibility to contribute to their superannuation, especially women and those with moderate balances.

The incentive for Australians aged 60 and over to sell the family home and move to housing that better suits their lifestyle should encourage turnover in a tightly-held market. By encouraging retirees to downsize, there will be more houses available for young families who are seeking to upsize.

Outlook for Perth

We are still seeing large number of buyers attending home opens and multiple offers being received on most good quality homes. Auctions are gaining popularity as we are seeing multiple buyers for each property. Real Estate Agents are using different sales methods, including “End Date Sales” “Offers” “All Offers Presented”, making it difficult to establish value in this market. Stock levels in some areas is extremely low and buyers need to constantly find new ways of searching for more options.

The outlook for houses in inner city and middle ring suburbs areas is demand is expected to stay strong and supply levels remaining low. A great time for downsizers and investors to take advantage of the great market conditions. We are starting to see more investment properties come to market and expect to see more post the end of the financial year.

At Resolve Property Solutions, we are constantly searching for options for our clients and finding new ways to locate and get access to property within their brief. May has been a busy month with 6 properties bought “On Market” 2 properties bought “Pre-Market” and 2 properties bought “Off Market”

If you would like to chat to our buyers agent about your property requirements and strategy, please give us a call on 0401 774 715 or email us today info@resolvepropertysolutions.com.au

We are here to help you on your property journey.