Perth Defies National Trend

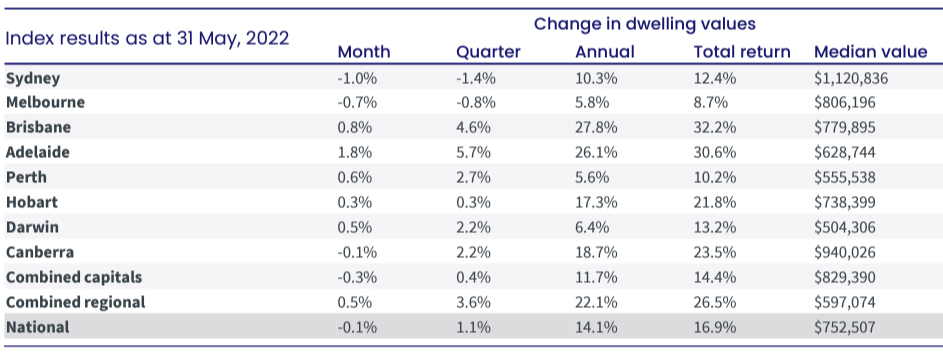

CoreLogic’s home value index for May recorded the first decline nationally since September 2020. Perth, however, continued to be one of the few exceptions to the national trend of decline.

Perth’s home value index increased by 0.6% in May, resulting in an increase in quarterly growth to 2.7%. Perth and Adelaide were the only two capitals to see their quarterly growth trends rise in May. Whilst Perth’s growth is below it’s peak rate, it is another month of solid growth and a stark contrast to the east coast property market trend.

Listings for sale in May for both Sydney and Melbourne were higher than the same time last year and also well above the five year average. As a result, houses are taking much longer to sell. Poorer selling conditions in these cities is putting buyers in control of the market.

Perth’s listings for sale for the month by comparison were well below the five year average. Although May saw an increase in stock compared to the previous month, there is still greater demand than supply. With an average selling time of just 13 days, buyers need to move quickly to get into the Perth property market.

Source: CoreLogic

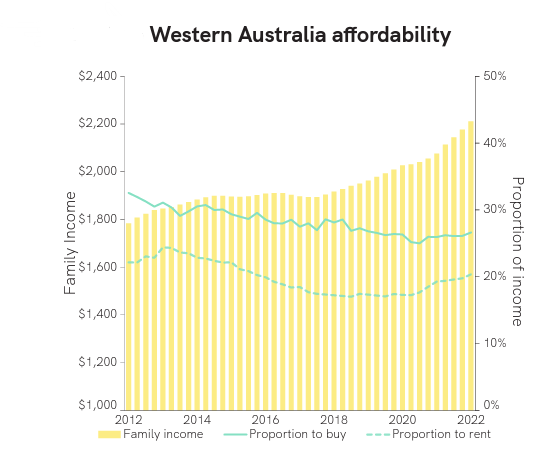

Affordability Maintained in Western Australia

The latest Real Estate Institute of Australia (REIA) Housing Affordability Report shows that despite the continued trend of growth in the Perth property market, it remains the second most affordable city in the nation to buy a house.

The report found that for the March 2022 quarter, only 26.6% of a families average weekly income is required to meet loan repayments in Western Australia. In NSW by comparison, 46.5% of income is required, and in QLD it’s 34%.

Western Australia has one of the lowest proportions in the nation, second only to the Northern Territory, where 24.8% of income is needed to meet loan repayments. Interestingly, Western Australia also has the second highest average weekly family income in the nation, second only to ACT.

REIA also calculate a home loan affordability indicator on a state and national level. Higher values represent better affordability of housing loans. Unsurprisingly, Western Australia has the second best affordability in the nation, being beaten only by the Northern Territory.

After seeing the second interest rate increase in as many months, the low portion of income required to service a home loan in Perth is one of the many reasons why confidence is high and buyers are still out in force.

Source: REIA

Perth may have recorded an overall increase of 0.6% for May, but numerous suburbs saw their prices rise well beyond that for the month. North Perth recorded the largest increase in average house sale prices for May by a significant margin, with prices growing by 4.5% to $1.1 million.

Second place went to Wembley Downs, where the average house sale price is now $1.31 million, a 2.7% increase for May. Close behind was Langford, where a 2.6% rise saw prices grow to $380,000. Just up the road, Wilson experienced a 2.5% increase in May, bringing average prices to $610,000.

Bedford rounded out the top five list in May, with prices rising 2.3% to $750,000, although buyers need to be quick, as Bedford was also the second fastest selling suburb for May, with an overage of only seven days on the market. Attadale and Kardinya also saw strong price growth throughout May.

Outlook for Perth

During the month of May we have continued to see investor activity remain strong, with eastern states buyers and enquiry levels remaining high. Weekly rental price increases and demand remains high with yields gathering strength. Good quality family homes are still in short supply as we continue to see upgraders, first home buyers and relocators entering the market. Downsizers are still facing tough competition and short supply of suitable properties.

The FOMO experienced over the past 12 months is starting to fade in some areas and buyers are now more then ever worried about overpaying. Most good properties are still being sold in record time with days on market continuing to stay low and multiple offers still being received most properties.

Given that affordability remains high in Perth and with less impact from rising interest rates compared to the rest of Australia, we are expecting demand to be maintained for the rest of the calendar year and prices to be sustained or see a modest increase.

What’s Happening at Resolve?

At Resolve Property Solutions, our team is working harder than ever to source and inspect as many suitable properties as possible for our clients. As well as sourcing properties which meet our clients brief and budget, we also search for off-market opportunities where possible to provide more options, and always ensure they are buying the right property at the right price.

Now more then ever it is important to get an accurate and up to date appraisal for your property purchase and avoid over paying.

During the month of May we purchased seven properties for our clients with over 40% off market or pre market purchases.

If you would like to discuss your property requirements and strategy with our buyers agents, book your free consultation here.

We are here to help you on your property journey.