Property Market Growth Drivers

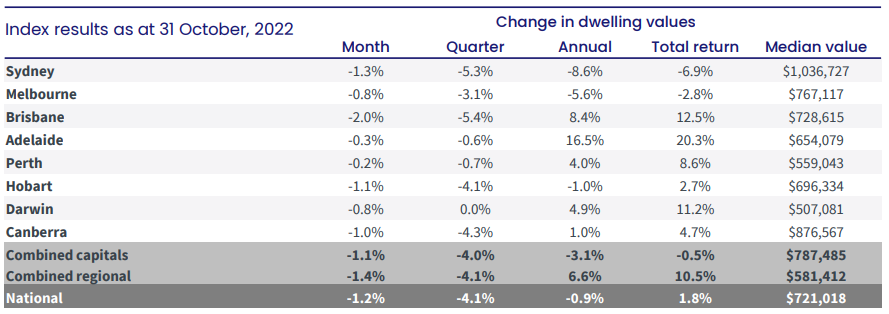

According to CoreLogic’s latest Home Value Index, every capital city experienced a downturn in housing values in October. Perth reported the smallest dip, at only -0.2%. It’s not all bad news though, because reducing house values mean buyers who were previously priced out, are back in the game.

Perth still has one of the lowest median house prices, making it highly affordable, notably for first home buyers. In fact, Perth has ten times as many houses for sale for $400,000 or less than Sydney or Melbourne do. However, whether you’re a first home buyer or an investor, just because a suburb is affordable doesn’t make it a smart investment.

Whilst proximity to the city or the beach can be important, these are not the only factors to consider when buying a property. Even if you plan to live a house, you want to ensure you’re spending your money wisely. Often buyers fall into the trap of finding a property and then trying to justify it as a good purchase.

A more prudent approach is to identify areas that have good growth drivers which are within your budget. What are some of the key drivers for growth?

The principle of supply and demand is an integral driver of growth and rental yields. When demand outweighs supply, prices and rental yields are driven upwards. An over abundance of supply will have the reverse effect.

An increasing population increases demand, and as already stated, higher demand equates to higher prices. Population growth can often also be an indicator of the economic strength of an area. Healthy economies create jobs and this generates wealth which increases living standards.

Although supply and demand, population growth and economic strength are key growth drivers, they are not the only ones. Buyers need to mindful of not looking at just one or two drivers in isolation, be sure to get the whole picture and avoid making a decision you later regret.

Source: CoreLogic

Perth Suburbs Moving Up

Whilst experiencing a slight decline overall, Perth’s property market continues to be comparatively stable, a fact which is underscored by the growth experienced in numerous suburbs. Quinns Rocks enjoyed the greatest increase in house sale prices, up 3.6% to $570,000.

At the other end of the coast, Warnbro, where buyers need to act swiftly, as houses are selling in just six days, grew 2.5% to $410,000. Close behind was Hamilton Hill, where prices increased to $595,000, a boost of 2.2%.

Both Butler and Currambine gained 1.9% in October, growing to $420,000 and $655,000 respectively.

Padbury, South Perth, Stirling and Pearsall also saw healthy increases in house prices for October.

Property Spotlight

Our team has been busy helping our clients secure their dream homes during October. Here’s a small sample of the properties secured during the month:

|

|

What’s Happening at Resolve?

At Resolve Property Solutions, our team is working harder than ever to source and inspect as many suitable properties as possible for our clients. As well as securing properties which meet our clients brief and budget, we also search for off-market opportunities where possible to provide more options, and always ensure they are buying the right property at the right price. Stock levels are at record lows, which is making it even more challenging to find the right property.

Now more then ever it is important to get an accurate and up to date appraisal for your property purchase and avoid over paying, with some segments and price points in the market showing less demand. Newer and renovated properties are in high demand and routinely sell above asking price.

During the month of October, we purchased 16 properties for our clients, with 50% of these being off or pre market.

If you would like to discuss your property requirements and strategy with our Buyers Agents, book your free consultation here.

We are here to help you on your property journey and ensure you are buying the right property, in the right location for the right price!