As a property investor in Perth, one of the key decisions you’ll face is whether to invest in a house or a unit. Like most decisions, there isn’t one answer as to which is better as each option has its pros and cons. You’ll need to weigh these up against your investment strategy to make an informed decision.

The benefits of investing in a house

Potential for capital growth

As a general rule, houses offer better long-term capital growth potential than apartments.

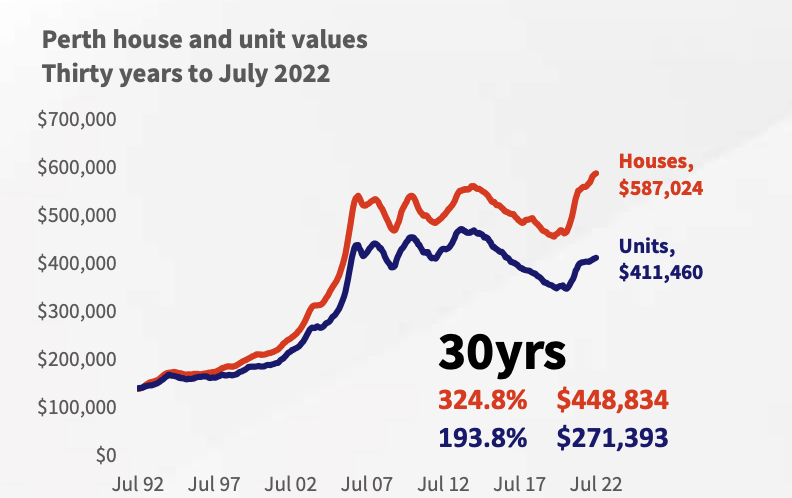

For instance, in the 30 years to July 2022, Perth house values grew 325%, while unit values were up 194%, according to CoreLogic (see graph below).

Why the difference? Well, houses usually have more land associated with them than units.

Land is scarce so it generally appreciates over time, while buildings depreciate in value due to maintenance concerns.

That said, location is everything. So a unit in a quality location with high demand could grow more in value than a house located somewhere less desirable,

Greater control

Owning a house allows you more freedom to make decisions about renovations, improvements, and maintenance without being bound by strata rules and regulations.

More space

Houses generally offer more space, with multiple bedrooms and a backyard. This, in turn, makes it more likely to attract families as tenants. Family-oriented properties can provide stability and longer-term tenancies, resulting in lower vacancy rates and a more consistent rental income stream.

The cons of investing in a house

Higher costs

Houses generally come with a higher purchase price compared to units in the same area, making them less accessible for some investors.

Increased maintenance

With a house, you’ll bear the responsibility of maintaining the property, including the exterior, landscaping, and any repairs or renovations. This can be time-consuming and costly.

The benefits of investing in a unit

Affordability

Units in Perth tend to be more affordable when compared to houses, making them an attractive option for entry-level investors or those with limited capital. Lower purchase prices can provide a greater potential for cash flow and higher rental yields.

Lower maintenance

As an investor, one of your primary concerns is the ongoing maintenance and upkeep of the property. With a unit, much of the exterior maintenance is usually taken care of by the strata management, reducing your responsibilities and costs.

Location

Units are often situated in central and sought-after locations with access to amenities such as public transport, shopping centres, and entertainment districts. This can make them appealing to tenants, potentially increasing rental demand and your capital growth prospects.

The cons of investing in a unit

Limited space

Units typically have less living space compared to houses, which may not appeal to tenants with larger families or those who require extra space for personal belongings.

Strata fees

Owning a unit involves paying regular strata fees to cover shared expenses such as building maintenance, insurance, and common area upkeep. These fees can impact your overall rental returns.

Lack of control

As a unit owner, you have limited control over certain decisions, as they are subject to the rules and regulations set by the strata management. This can restrict your ability to modify or renovate the property as you see fit.

Looking to buy an investment property in Perth? As an expert Perth buyer’s agent, Resolve Property Solutions can help. To discuss your options, book a free strategy call with Peter Gavalas.