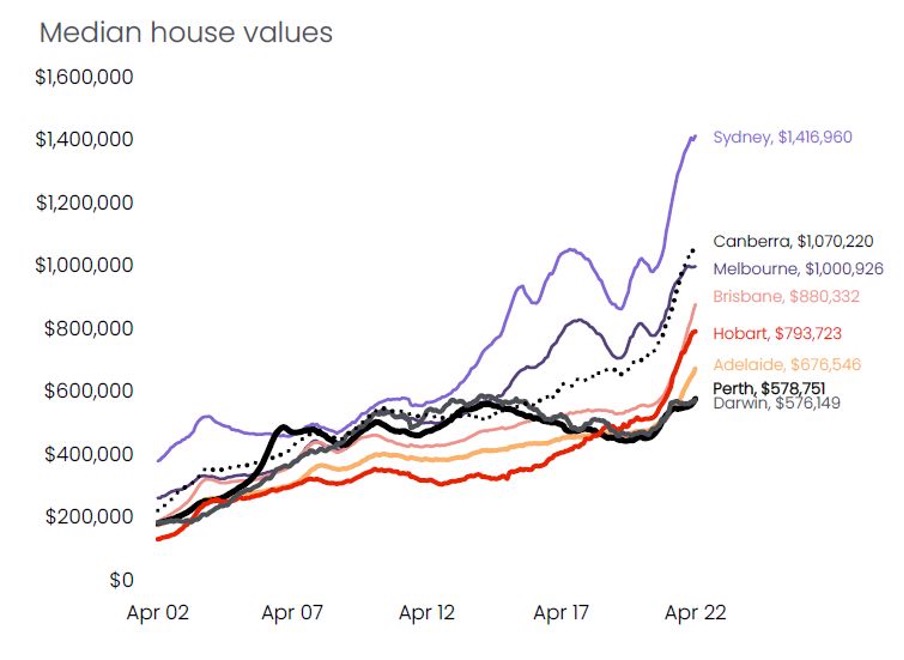

Sydney and Melbourne median house values have largely been rising since 2012 & 2013 respectively with the exception of some APRA interventions and COVID-19.

COVID-19 stimulus and low interest rates extended and exacerbated these two property cycles for longer than would have occurred in normal market and rate conditions.

The Perth property market however is on a different cycle. After peaking in 2014, it finally reached it’s low in October 2019.

Perth is less than 3 years into its current property cycle, however, the outlook is good. Perth is the most affordable capital city in Australia, offers one of the highest rental yields, has low vacancy rates and increased population growth. These factors equate to growth being expected to continue through the current rising interest rate cycle.

When commenting on the outlook of the Australia property market, even some of the most bearish economists agree with Christopher Joye, who stated “Perth market will be long and strong.”

Head of Market Economics and leading economist Stephen Koukoulas also believes the Perth market will still perform well, due to affordability being so good, the mining investment and interstate migration.

Source: CoreLogic