Perth Enters the Spring Time Selling Season

Perth’s property market is growing at an average rate of 0.9% per month, which is nearly twice as high as the average monthly rate of 0.5% recorded during the 2011-14 growth cycle.

The 2014 peak represented price growth of 15% for Perth, over a period of 30 months. The first 12 months of that growth cycle saw only 6% total price growth. Comparatively, just 12 months into the current growth cycle, prices have already increased almost 11%, and the majority of that growth has occurred in the first six months of 2021.

Given that Perth experienced one of it’s wettest ever winters, it is not surprising that the growth rate slowed to 0.2% in June and 0.3% in July, Interestingly, the same trend was observed during the previous growth cycle, which experts say sets a good precedent for why we shouldn’t read too much into winter slowdowns.

Moving into the spring selling season with warmer weather, the Perth market recovery will start to accelerate once again. Record attendance numbers at open homes over the last four weeks prove this acceleration has already begun.

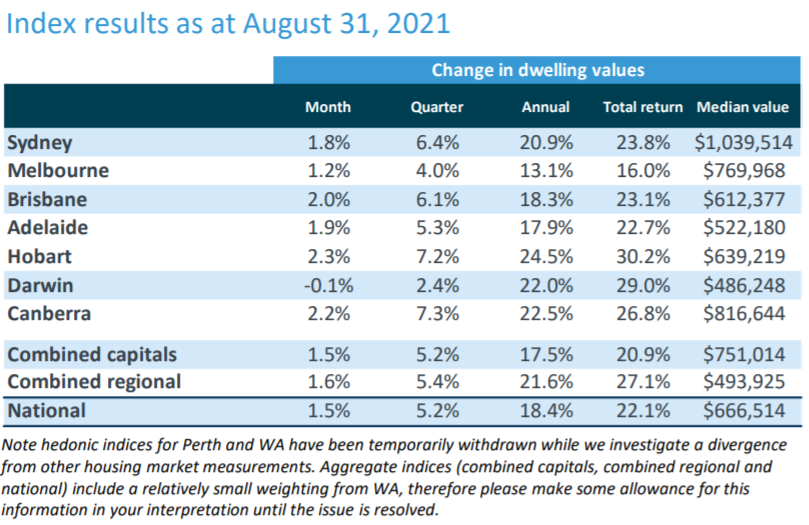

Source: CoreLogic

Capital Growth Surpasses Household Income

Homes in more than 15 suburbs across WA made more money in the past year than their owners earned by going to work every day, new figures from Domain and ABS show.

Homes in the top five, City Beach, Salter Point, Cottesloe, Floreat and Dalkeith, saw their yearly capital growth outstrip post-tax annual average income of owners by at least $200,000.

The largest difference was seen in City Beach, where the annual change in the average property price was $390,000. This means that houses were earning $225,695 more than their owners annual household wages of $164,305.

In Salter Point, houses earned $202,402, while their owners annual household wages were $115,098, with the annual gain in the average property price equalling $317,500.

These strong performing suburbs are indicative of Perth’s market recovery being led by top-end suburbs. And over the next year, middle-ring suburbs are likely to follow the same trend, which is notable as this type of growth is not something that happens annually. Usually this type of growth is only experienced only once or twice over a 10 year period.

Investors Are Back In Perth

Perth house prices reached a six year high over the June 2021 quarter. This represents the strongest annual increase in 11 years, up 12.3% or $65,000. House prices are still $20,000 less than the 2014 peak, however, they are on track to surpass this previous peak early in 2022.

For potential buyers, this diminishing price gap will be reinforcing their sense of urgency to buy now. However, Perth is still one of the most affordable cities to purchase in, as house prices rise rapidly across the other cities.

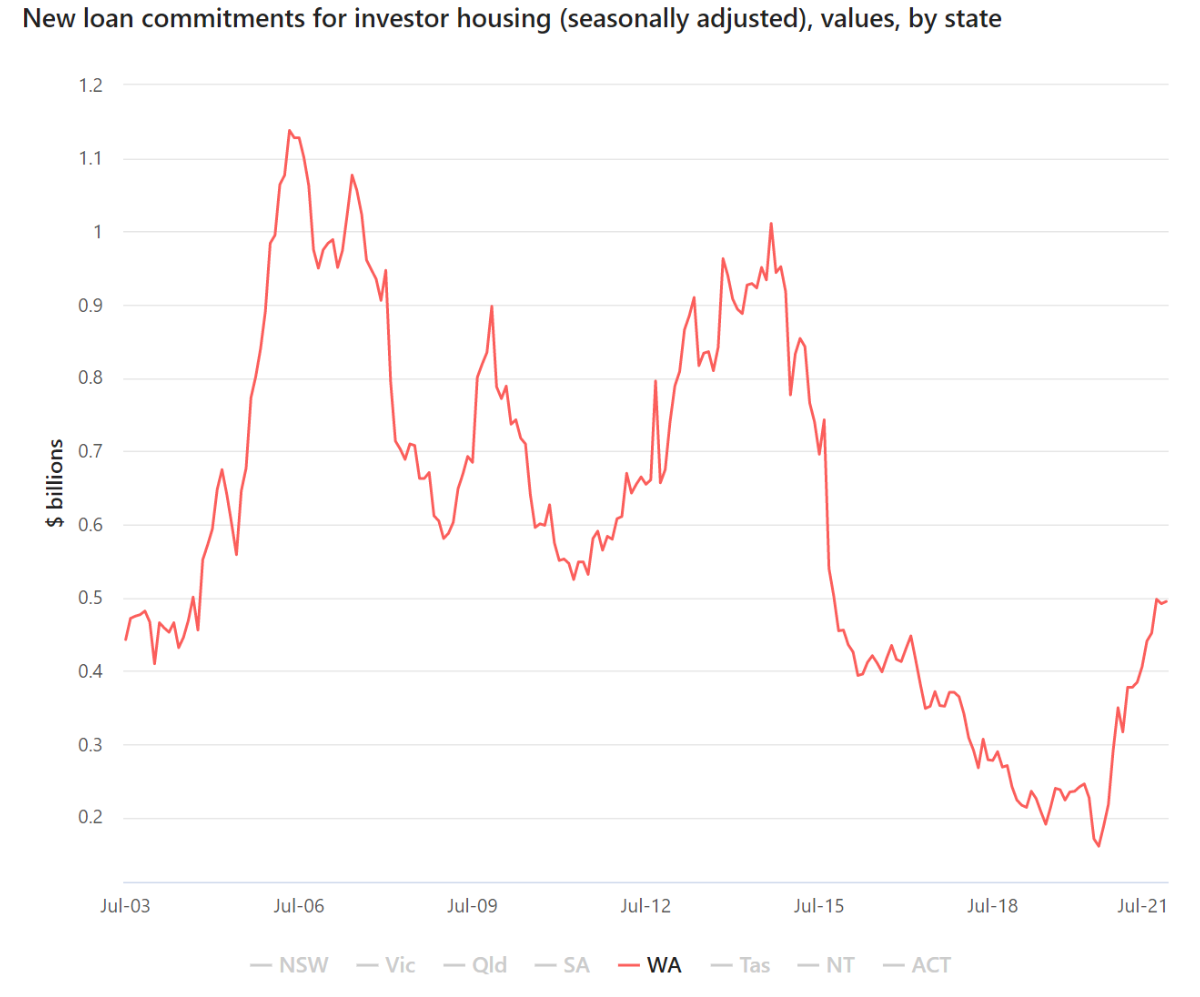

Buyer demand is high and the conditions supporting this remain strong. 2021 saw the busiest June quarter since 2014 for both house and unit sales. Perth’s affordability, tight rental market and capital growth prospects have attracted investors back into the market, as the below graph shows. At Resolve Property Solutions, we have seen more investors entering the WA market, with rising enquiry levels from further investors.

With the ceasing of the state government’s rental moratorium on evictions and rental prices, allowing landlords to hike rents in line with the market rate, investor activity is likely to continue to rise. Relocation for the resources sector and changing border restrictions have caused internal migration into Greater Perth to reach it’s highest level since 2013.

Source: ABS

Outlook for Perth

Spring has finally hit and with some warm weather, we are expecting to see a few more new listings on the market. Buyer demand hasn’t subsided over the last month, with highly sought after properties seeing multiple offers received and prices well above the asking.

Blue-chip suburbs are seeing renewed demand and growth. Each sale is setting a new record and multiple buyers are missing out, as more investors and owner occupiers recognise the long-term value of buying in these locations.

Low-interest rates, lack of supply and buyers desire for more space are all factors driving up demand for large family homes on big blocks. People are putting a lot more value on space, lifestyle factors and proximity to amenities and recreation.

Investor activity is continuing to rise as affordability, high yields and good growth prospects entice more investors into the Perth market. Eastern states investors are increasing weekly. We are also seeing a growing number of people relocating to Perth from the east coast, looking for a better lifestyle, safer city and better value properties.

We are expecting this buyer demand to be maintained as we start to see more expats coming home, along with skilled migrants returning to Australia and Perth.

Finding the right property in this market is challenging and competitive. You need an expert on your side to help you, increase your opportunities and give you the best chance of securing your property.

If you would like to chat to our buyers agent about your property requirements and strategy, please give us a call on 0401 774 715 or email us today info@resolvepropertysolutions.com.au.

We are here to help you on your property journey.